– Advertisement –

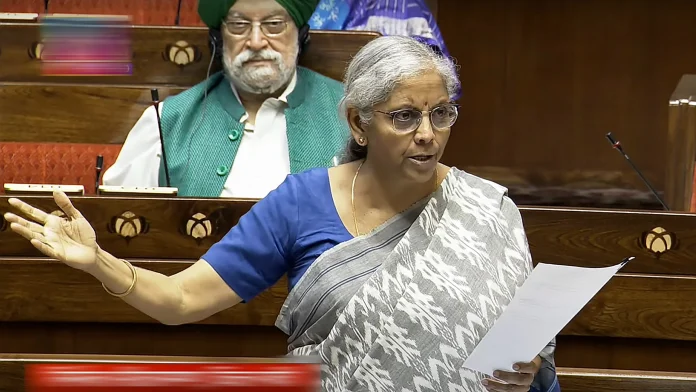

Finance Minister Nirmala Sitharaman will present this new Income Tax Bill in the Lok Sabha today. A special committee of the Lok Sabha has recommended making the tax rules on lump sum pension withdrawal equal for all in the new Income Tax Bill.

If this proposal becomes law, then people will be able to avail tax exemption on lump sum pension withdrawal as well.

The government is preparing to bring a big relief to those who invest in private pension schemes. A special committee of the Lok Sabha has recommended making the tax rules on lump sum pension withdrawal equal for all in the new Income Tax Bill. Earlier, only government and some private sector employees used to get tax exemption on this, while non-working people who invested on their own did not get any exemption. The committee has proposed to remove this difference.

What was the difference from the existing rules?

According to the system till now, employees of the central or state government and the army were completely exempted from tax on the lump sum pension amount received on retirement. Some employees of the private sector were given partial exemption.

If they have received gratuity, then on one-third amount, otherwise on half amount. However, those who have invested in recognized private pension schemes like LIC on their own (such as self-employed or freelancers), had to pay tax on the entire amount on withdrawing the lump sum pension. The committee has not considered this inequality to be right.

Who will get the benefit?

If this proposal becomes law, the following people will be able to avail tax exemption on lump sum pension withdrawal as well…

Self-employed professionals: Such as doctors, lawyers, artists or freelancers who have invested in a recognised pension fund on their own.

Such private sector employees whose company does not have any pension scheme, but they themselves have invested money in an approved pension scheme.

Legal heir or nominee: In case of death of the pension account holder, the lump sum amount received by his dependents or nominee will also be eligible for exemption.

Beneficiaries of group insurance pension: Those who are not direct employees of an organisation but receive benefits from its approved pension fund.

What is lump sum pension withdrawal?

Lump sum pension withdrawal (commuted pension) means that at the time of retirement a person can take a part of his total pension amount immediately as a large sum. The remaining part continues to be received as regular pension every month. Before the new rule, most people had to pay full tax on this large sum received immediately.

What does the government say?

The government believes that this change will reduce the tax burden on more people who are retiring. This will increase people’s savings and their financial security will also improve after retirement. Financial experts also believe that this step will bring uniformity in tax rules between government and private sector employees.

Other proposed changes in the Bill

Apart from this, the committee has also recommended improvements in some other rules related to income tax…

Relaxation in ITR requirement: Now it will not be necessary to file a full ITR just for TDS (tax deducted at source) refund. Instead, it is proposed to fill a simple form.

Refund even on late filing of returns: According to the first proposal, there was no refund on filing returns after a certain deadline. The committee has recommended changes in this so that those who file returns late can also get a refund.

Zero TDS Certificate: Taxpayers will be able to get the facility of getting a Zero TDS certificate even before the tax is deducted, so that no tax will be deducted on their income.

New Income Tax Bill will be presented in Lok Sabha today

Finance Minister Nirmala Sitharaman will introduce this new Income Tax Bill in the Lok Sabha. The Lok Sabha Select Committee headed by BJP member Baijayant Panda gave 285 suggestions on the Income Tax Bill, which were accepted by the government. If this bill is passed, this change can bring financial relief to millions of people investing in private pension schemes.

– Advertisement –

#Income #Tax #Bill #Preparations #Implement #Tax #Exemption #private #Pension #Schemes #WhoWiki.org