You also check whether you do not have an account in this bank. RBI has imposed restrictions on the bank, while the bank has set a limit of withdrawing up to Rs 5,000 for the customers. Read this news…

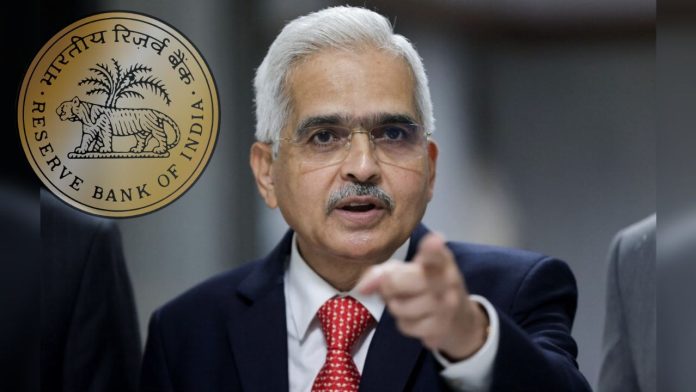

Taking several actions against a bank in Tamil Nadu, the Reserve Bank of India (RBI) has imposed restrictions on it. You check once and see whether your account is also not in this bank, because RBI has not only imposed a ban, but has also set a limit of withdrawing only Rs 5,000 for the customers of the bank.

RBI has imposed several restrictions on Musiri Urban Co-operative Bank of Tamil Nadu due to deteriorating financial condition. These restrictions on the bank will remain in force for 6 months from March 3. During this, RBI will conduct a comprehensive review of the functioning of the bank. And for customers also this limit will be applicable for 6 months.

Bank will not be able to do this work

Due to the restrictions of RBI, the co-operative bank cannot make any investment during this period. Nor can he give or pay any kind of loan. If it is also necessary for the bank to do so, then it will have to take approval from RBI. Not only this, the bank cannot even dispose of any of its assets during this period.

However, the Reserve Bank also made it clear that these instructions should not be taken as cancellation of the banking license of the bank. The bank will continue to do banking business with restrictions till its financial position improves. It said it may consider amending the instructions depending on the circumstances.

Customer limit for 6 months

RBI made it clear that all savings, current or otherwise account holders of the bank will be allowed to withdraw only up to Rs 5,000 from their balance deposits. Account holders will be able to withdraw this much amount in full 6 months only.

However, the money of the customers should be safe. For this, all the account holders of the bank will get the facility of deposit insurance and insurance of up to five lakh rupees from the Credit Guarantee Corporation. That is, even in the event of the closure of the bank, he will be entitled to a deposit of up to Rs 5 lakh.

The Reserve Bank of India constantly works to monitor the functioning of banks. In view of the situation of any kind of financial disturbance, the central bank bans its functioning.

#Cash #Withdrawal #Limit #Fixed #Big #shock #bank #customers #RBI #banned #withdrawal #thousand #cash #account #WhoWiki.org