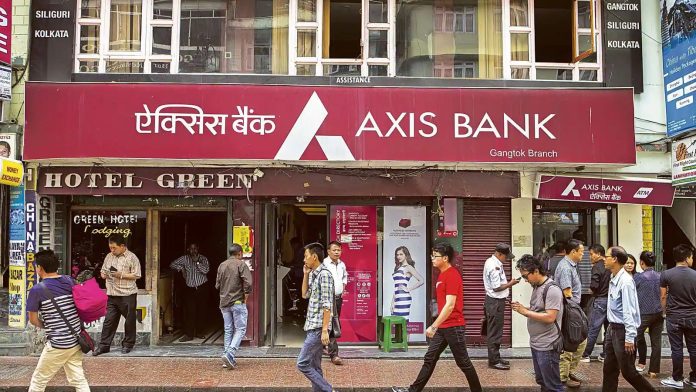

Axis Bank Savings Account Charges Revised from 1 April 2023: Axis Bank has changed the fees for various services including service charge for salary and savings account holders.

Axis Bank has revised the service charge for salary and savings account holders. Apart from this, the bank has also changed the fees on various services. According to the bank, the service charge applicable on many 9 banking services including average balance, minimum balance maintenance, free cash transaction limit, DD issuance fee has been revised. According to Axis Bank, the new tariff structure for savings, salary and trust accounts is being implemented with effect from 1 April 2023.

Changes in charges for non-maintenance of minimum average balance

Non-maintenance charges have been waived off for accounts with a shortfall of up to Rs 500 from the required minimum average balance, according to Axis Bank’s website. Non-maintenance fee is not applicable for premium accounts if 25% of the required TRV is maintained.

Zero balance accounts like Small and Basic Accounts, Salary Accounts, Defense Accounts, Mahila Pratham Card Accounts, Yuva Savings Accounts, Sahaj Accounts, Pension Accounts, Trust and FCRA Accounts have been excluded from the app.

Average Balance Amount for Prestige Savings Accounts

The minimum balance for Prestige Savings Accounts has changed from Average Quarterly Amount of Rs.75,000 to Average Monthly Balance (AMB) of Rs.75,000 as per Axis Bank website.

These changes will be applicable for Axis Bank account holders from April 1

- There has been a change in the service charge of the savings account for senior citizens.

- Delivery return charges have been introduced.

- The charges applicable in case of NACH debit failure has been changed.

- There has been a change in the inward check return charges.

- DD issue fee has been revised.

- The limit on free cash transactions has been rationalised.

#Axis #Bank #Service #Charge #Revised #Axis #Bank #revises #service #charge #salary #savings #account #holders #WhoWiki.org