– Advertisement –

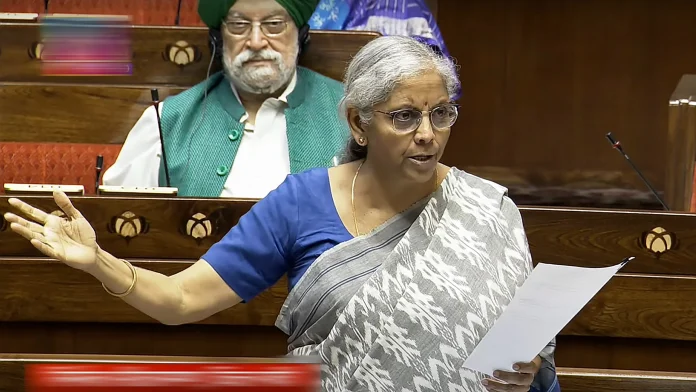

New Income Tax Bill Passed Loksabha: The new Income Tax Bill, 2025 has been passed in the Lok Sabha. Finance Minister Nirmala Sitharaman introduced the Revised Income Tax Bill in the Lok Sabha. It was earlier withdrawn to incorporate certain recommendations of the select panel of the Lok Sabha.

The new Income Tax Bill has been passed in the Lok Sabha. It was earlier withdrawn to incorporate certain recommendations of the Lok Sabha’s select panel. Another bill, the Taxation Laws (Amendment) Bill, was also passed in the Lok Sabha. The bill aims to provide tax exemption to subscribers of the Unified Pension Scheme. Both the bills were passed without any debate as the opposition continued to protest demanding discussion on various issues including SIR. The government has incorporated almost all the recommendations of the select committee in the new revised Income Tax Bill .

New income tax bill passed without discussion

Union Finance Minister Nirmala Sitharaman on Monday introduced the revised version of the new Income Tax Bill, 2025 in the Lok Sabha amid opposition uproar. It includes most of the recommendations from the Parliamentary Select Committee headed by BJP leader Baijayant Panda. This new bill is going to replace the old laws, Income Tax Act 1961. This bill has been approved by the Lok Sabha without discussion.

Nirmala Sitharaman told what is in the bill

While introducing the bill in the Lok Sabha, Finance Minister Sitharaman said that many suggestions were received, which were required to be incorporated to provide the correct legislative meaning. She said that improvements have been made in the nature of drafting, alignment of phrases, resulting changes and cross referencing. The earlier bill was withdrawn to avoid confusion. Now the new Income Tax Bill 2025 has been passed in the Lok Sabha.

The opposition raised questions on passing the bill without discussion

The opposition has raised questions on the passing of the new Income Tax Bill. Samajwadi Party chief and MP Akhilesh Yadav reacted to the new Income Tax Bill 2025. He said that such a big decision was taken without discussion in the House. Some new changes are going to be made in the Income Tax Bill. Everyone has seen the situation of demonetization, GST. Now America is also increasing tariffs. Business is dependent on China, we are seeing all this. Akhilesh Yadav further said that where are we taking the country? How will a developed India be created in Amrit Kaal, these are big questions.

285 suggestions included in the updated income tax bill

Earlier, while introducing the new Income Tax Bill in the Lok Sabha, Nirmala Sitharaman said that the revised bill will improve fairness and clarity. It will bring the law in line with the existing provisions. The new draft aims to provide MPs with a single, updated version, which reflects all the suggested changes. The updated Income Tax Bill 2025 incorporates 285 suggestions from the Parliamentary Select Committee.

Why was the new income tax bill introduced?

The new law aims to simplify tax processes and remove past loopholes, potentially transforming the income tax landscape in the country. Last week, the government formally withdrew the Income Tax Bill, 2025, which was introduced in the Lok Sabha on February 13 to replace the existing Income Tax Act, 1961.

These are the big changes in the Revised Income Tax Bill

According to the government, the revised bill has made extensive changes in slabs and rates to benefit all taxpayers. The new structure will reduce taxes for the middle class and leave more money in their hands, which will boost domestic consumption, savings and investment.

– Advertisement –

#Income #Tax #Bill #Passed #Key #Highlights #Announced #Finance #Minister #WhoWiki.org